NCB Launches 2025 Version of Digital Banking for Corporate Customers with Outstanding New Features

The National Citizen Commercial Joint Stock Bank (NCB) has officially launched the latest version of its digital banking platform, NCB iziBankbiz, featuring a completely revamped interface, enhanced functionalities, and improved processing speed—promising to be an optimal financial management tool for enterprises in the digital age.

A Powerful Digital Assistant for Businesses

Accompanying enterprises in their business operations and digital transformation journey, NCB’s digital banking platform iziBankbiz—offered in two convenient formats: Internet Banking via web browser and Mobile Banking via the NCB iziMobiz app—has quickly established itself as an indispensable “digital assistant” for thousands of businesses since its debut. NCB iziBankbiz seamlessly connects with all online financial services to meet customer needs, enabling business owners and specialized departments to easily operate with a consistent experience across all devices—from computers to smartphones and tablets—24/7.

By providing comprehensive solutions and superior utilities, helping businesses completely eliminate the need for paper documents typical of traditional methods, and optimizing operating and staffing costs, NCB iziBankbiz has become increasingly favored by Vietnamese enterprises. It has been honored for two consecutive years at the “Top 50 Trusted Products and Services in Vietnam” awards.

NCB iziBankbiz honored two years in a row

at the “Top 50 Trusted Products and Services in Vietnam” Awards

With just a few simple steps, all transactions—such as cash flow management, information inquiries, account report generation, bill payments, scheduled transfers, or employee payroll—can be executed online swiftly, safely, and proactively. Moreover, NCB iziBankbiz’s flexible authorization mechanism allows users to proactively create user groups and assign account-based permissions. This feature not only supports business managers in operating effectively according to their organization’s model but also eases staffing burdens, optimizes operational processes, and promotes sustainable growth.

Premium Interface, Intelligent Features, and Seamless Experience

The new version makes a strong impression with a modern, youthful interface

and layout optimized for user experience

With continuous efforts to digitize financial operations and deliver leading modern, convenient financial solutions to corporate customers—especially small and medium-sized enterprises—NCB has upgraded its digital banking platform, NCB iziBankbiz, to the superior 2025 version.

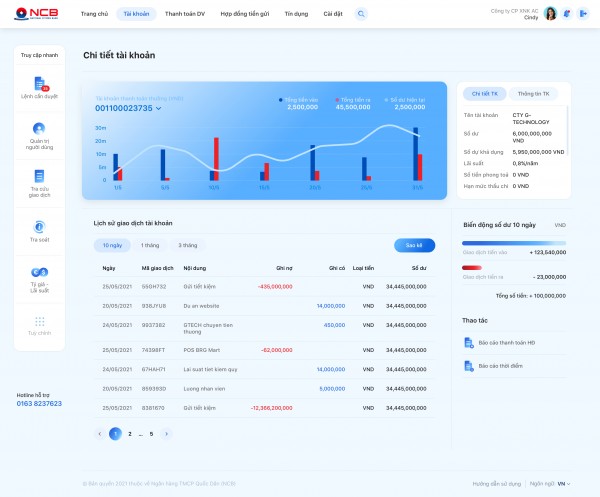

While remaining user-friendly and convenient, the new version impresses with a modern, youthful interface and an optimized layout. Notably, the home screen has been upgraded with a smart, intuitive design. One of the standout features is the enhanced Account Management section, now displaying an overview of cash flows over the past 7 days through dynamic graphs. This allows managers to easily and quickly grasp financial data, supporting trend analysis for accurate and timely decision-making.

“The new interface of NCB iziBankbiz truly impressed me. Essential information is clearly and professionally presented, while features are arranged in a highly logical manner, allowing for quick operations and easy information retrieval,” shared Ms. Nguyen Thi Lan, Director of a business.

In this latest version, the transaction approval notification feature has also been significantly upgraded. As soon as a pending transaction arises, a notification is instantly sent, enabling account owners to promptly receive updates and make timely decisions. The new version also allows for unlimited batch approvals in both Internet Banking and Mobile Banking (NCB iziMobiz), significantly saving users’ approval time. This ensures uninterrupted cash flow, enabling businesses to maintain smooth operations without concerns about financial disruptions. Additionally, the 2025 version of NCB iziBankbiz introduces a new convenient QR code generation feature. With a single simple step, businesses can create and share account information quickly, helping save time and minimize potential errors.

NCB iziBankbiz – A Powerful Assistant for Corporate Customers

Continuing to enhance user experience and emphasizing flexibility, the latest version of NCB iziBankbiz also expands its user scope, catering to businesses of varying scales. The role assignment feature, previously limited to 5 separate user groups and highly appreciated by customers, has now been expanded to 12 groups—offering maximum flexibility. This intelligent authorization system not only enables enterprises to manage operations closely by hierarchy but also ensures absolute security and optimizes operational efficiency.

With robust enhancements in the 2025 version, NCB iziBankbiz continues to affirm its position as a leading digital banking platform favored by a wide range of users, helping businesses optimize financial management and improve operational efficiency.

For more information about NCB’s products and services, customers can contact any NCB branch/transaction office nationwide or call the hotline: (028) 38 216 216 – 1800 6166.